Federal Reserve Economic Data

- Release Calendar

- FRED Tools

- FRED News

- FRED Blog

- About FRED

Data in this graph are copyrighted. Please review the copyright information in the series notes before sharing.

Notes

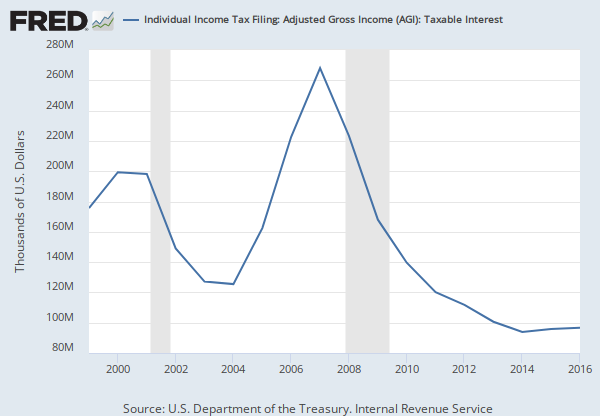

Source: U.S. Department of the Treasury. Internal Revenue Service

Release: SOI Tax Stats - Historical Data Tables

Units: Thousands of U.S. Dollars, Not Seasonally Adjusted

Frequency: Annual

Notes:

Ordinary dividends in Adjusted Gross Income (AGI) exclude capital gains and liquidating dividends, reflected in the statistics for net capital gain or loss in AGI, but include interest from Regulated Investment Companies on money market mutual funds. Qualified dividends are the ordinary dividends received after May 5, 2003, that met certain conditions. These included: the dividend must have been paid by a U.S. corporation or a "qualified" foreign corporation; the stock ownership must have met certain holding period requirements; the dividends were not from certain institutions, such as mutual savings banks, cooperative banks, credit unions, tax-exempt organizations, or farmer cooperatives; and the dividends were not for any share of stock which was a part of an employee stock ownership plan (ESOP).

For additional information about the return filing requirements, see the annual reports, Statistics of Income-Individual Income Tax Returns at https://www.irs.gov/uac/soi-tax-stats-historical-data-tables.

Suggested Citation:

U.S. Department of the Treasury. Internal Revenue Service, Individual Income Tax Filing: Adjusted Gross Income (AGI): Qualified Dividends [QLFDIVA], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/QLFDIVA, .

Release Tables

Permalink/Embed

modal open, choose link customization options

Select automatic updates to the data or a static time frame. All data are subject to revision.