Federal Reserve Economic Data

- Release Calendar

- FRED Tools

- FRED News

- FRED Blog

- About FRED

Data in this graph are copyrighted. Please review the copyright information in the series notes before sharing.

NOTES

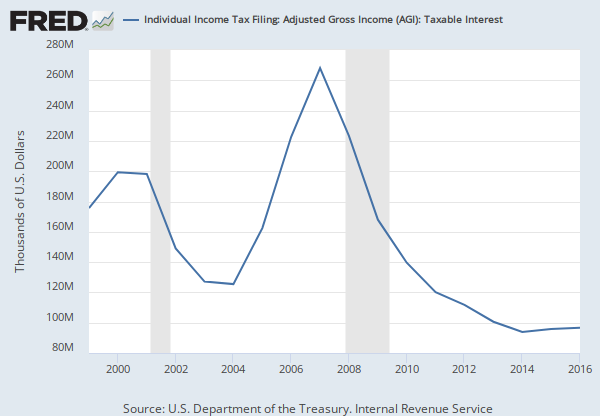

Source: U.S. Department of the Treasury. Internal Revenue Service

Release: SOI Tax Stats - Historical Data Tables

Units: Thousands of U.S. Dollars, Not Seasonally Adjusted

Frequency: Annual

Notes:

This series doesn't include deficit.

For additional information about the return filing requirements, see the annual reports, Statistics of Income-Individual Income Tax Returns at https://www.irs.gov/uac/soi-tax-stats-historical-data-tables.

Suggested Citation:

U.S. Department of the Treasury. Internal Revenue Service, Individual Income Tax Filing: Adjusted Gross Income (AGI) [AGICM], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/AGICM, .

RELEASE TABLES

RELATED DATA AND CONTENT

Data Suggestions Based On Your Search

Content Suggestions

Related Categories

Releases

Tags

Permalink/Embed

modal open, choose link customization options