Federal Reserve Economic Data

- Release Calendar

- FRED Tools

- FRED News

- FRED Blog

- About FRED

Data in this graph are copyrighted. Please review the copyright information in the series notes before sharing.

Notes

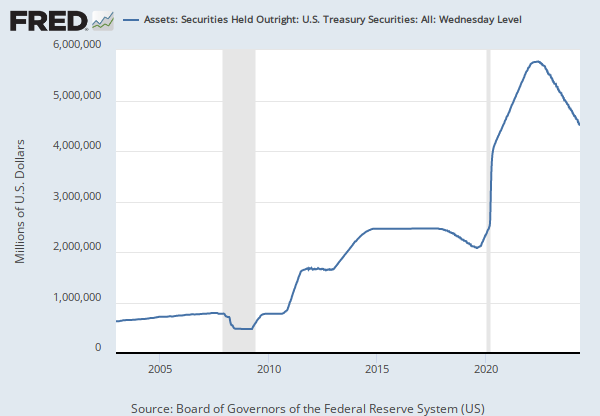

Source: Board of Governors of the Federal Reserve System (US)

Release: H.4.1 Factors Affecting Reserve Balances

Units: Millions of U.S. Dollars, Not Seasonally Adjusted

Frequency: Weekly, As of Wednesday

Notes:

Reverse repurchase agreements are transactions in which securities are sold to primary dealers or foreign central banks under an agreement to buy them back from the same party on a specified date at the same price plus interest. Reverse repurchase agreements absorb reserve balances from the banking system for the length of the agreement. They are typically collateralized using Treasury bills. As with repurchase agreements, the naming convention used here reflects the transaction from the dealers' perspective; the Federal Reserve receives cash in a reverse repurchase agreement and provides collateral to the dealers.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Liabilities and Capital: Liabilities: Reverse Repurchase Agreements: Maturing in 16 Days to 90 Days: Wednesday Level [RREP1690], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/RREP1690, .

Release Tables

Permalink/Embed

modal open, choose link customization options

Select automatic updates to the data or a static time frame. All data are subject to revision.