Federal Reserve Economic Data

- Release Calendar

- FRED Tools

- FRED News

- FRED Blog

- About FRED

Data in this graph are copyrighted. Please review the copyright information in the series notes before sharing.

Notes

Source: Board of Governors of the Federal Reserve System (US)

Release: H.4.1 Factors Affecting Reserve Balances

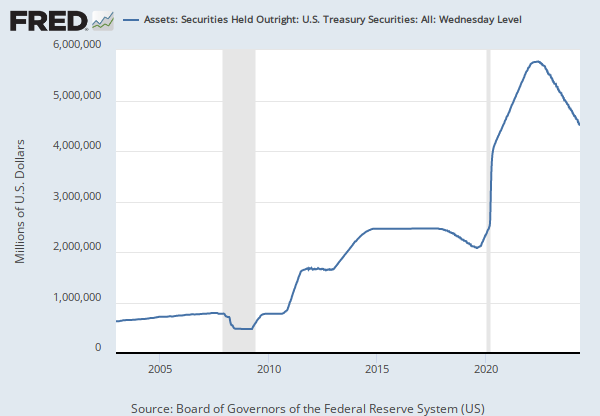

Units: Millions of U.S. Dollars, Not Seasonally Adjusted

Frequency: Weekly, As of Wednesday

Notes:

The total face value of U.S. Treasury securities held by the Federal Reserve. This total is broken out in the lines below. Purchases or sales of U.S. Treasury securities by the Federal Reserve Bank of New York (FRBNY) are made in the secondary market, or with various foreign official and international organizations that maintain accounts at the Federal Reserve. FRBNY's purchases or sales in the secondary market are conducted only through primary dealers.

Bills: The current face value of the Federal Reserve's outright holdings of Treasury bills.

Notes and bonds, nominal: The current face value of the Federal Reserve's outright holdings of nominal Treasury notes and bonds.

Notes and bonds, inflation-indexed: The current face value of the Federal Reserve's outright holdings of inflation-indexed Treasury notes and bonds.

Inflation compensation: Inflation compensation reflects adjustments for the effects of inflation to the principal of inflation-indexed securities.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Assets: Securities Held Outright: U.S. Treasury Securities: Maturing in over 10 Years: Wednesday Level [TREAS10Y], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/TREAS10Y, .

Release Tables

Permalink/Embed

modal open, choose link customization options

Select automatic updates to the data or a static time frame. All data are subject to revision.