Federal Reserve Economic Data

- Release Calendar

- FRED Tools

- FRED News

- FRED Blog

- About FRED

Data in this graph are copyrighted. Please review the copyright information in the series notes before sharing.

Notes

Source: Haver Analytics

Source: Federal Reserve Bank of St. Louis

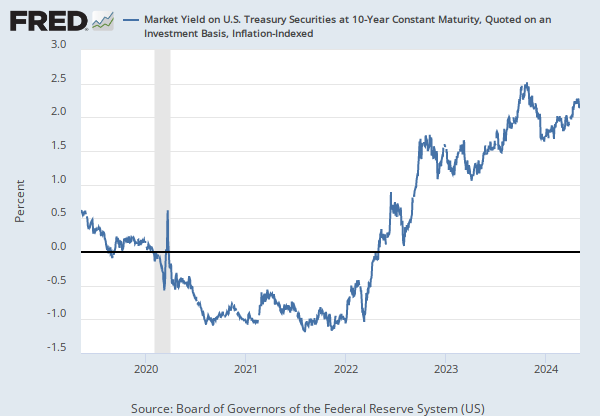

Release: Weekly Treasury Inflation-Indexed Securities

Units: Percent, Not Seasonally Adjusted

Frequency: Weekly, Ending Friday

Notes:

This series will no longer be updated. It has been replaced with DTP20J29 that updates on a daily basis.

Yield to maturity on accrued principal.

Weekly average of daily data calculated by the Federal Reserve Bank of St. Louis. Treasury Inflation-Protected Securities, or TIPS, are securities whose principal is tied to the Consumer Price Index (CPI). The principal increases with inflation and decreases with deflation. When the security matures, the U.S. Treasury pays the original or adjusted principal, whichever is greater.

Copyright, 2016, Haver Analytics. Reprinted with permission. Calculated from data provided by the Wall Street Journal.

Suggested Citation:

Haver Analytics and Federal Reserve Bank of St. Louis, 20-Year 2-1/2% Treasury Inflation-Indexed Bond, Due 1/15/2029 (DISCONTINUED) [WTP20J29], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/WTP20J29, .

Release Tables

Related Data and Content

Data Suggestions Based On Your Search

Content Suggestions

Related Categories

Releases

Tags

Permalink/Embed

modal open, choose link customization options

Select automatic updates to the data or a static time frame. All data are subject to revision.