Federal Reserve Economic Data

- Release Calendar

- FRED Tools

- FRED News

- FRED Blog

- About FRED

Data in this graph are copyrighted. Please review the copyright information in the series notes before sharing.

Notes

Source: Board of Governors of the Federal Reserve System (US)

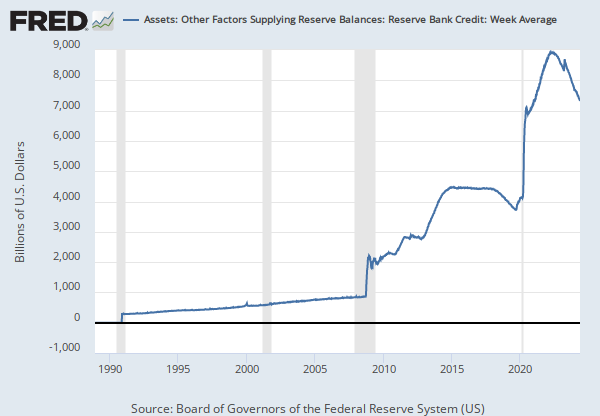

Release: H.4.1 Factors Affecting Reserve Balances

Units: Millions of U.S. Dollars, Not Seasonally Adjusted

Frequency: Weekly, As of Wednesday

Notes:

Reserve balances can be affected by mismatches in check-clearing operations. When a check is received by a Reserve Bank, the depositing institution's account is credited according to a fixed schedule, regardless of when the check is presented to the bank on which it is drawn. When there are delays in the presentment of checks to the paying institution, the receiving institution's account is credited before the account of the paying depository institution is charged, elevating reserve balances. Conversely, if the paying institution's account is debited faster than the schedule for crediting the receiving institution's account, reserve balances are reduced. These increases or decreases in reserve balances that result from mismatches in the timing of check clearing are known as float. Float figures include the net amount of float-related adjustments.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Assets: Other Factors Supplying Reserve Balances: Float: Wednesday Level [WOFSRBFL], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/WOFSRBFL, .

Release Tables

Permalink/Embed

modal open, choose link customization options

Select automatic updates to the data or a static time frame. All data are subject to revision.