Federal Reserve Economic Data

- Release Calendar

- FRED Tools

- FRED News

- FRED Blog

- About FRED

Data in this graph are copyrighted. Please review the copyright information in the series notes before sharing.

Notes

Source: Anderson, Richard G.

Source: Jones, Barry E.

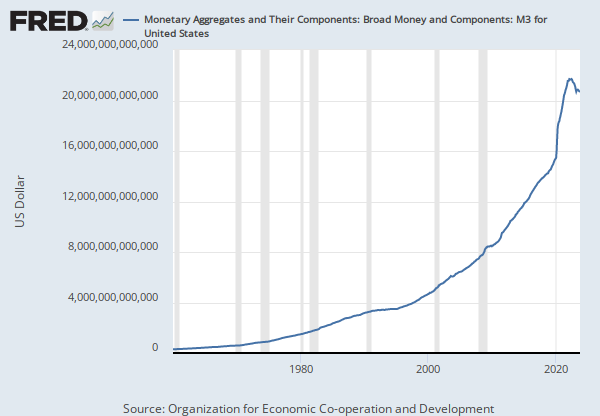

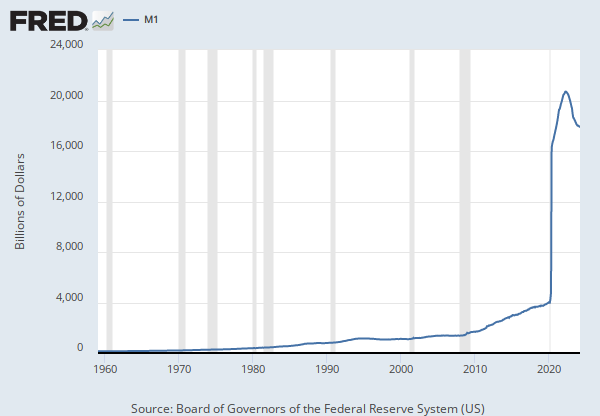

Release: Monetary Services Index (MSI)

Units: Billions of Dollars, Seasonally Adjusted

Frequency: Monthly

Notes:

The MSI measure the flow of monetary services received each period by households and firms from their holdings of monetary assets (levels of the indexes are sometimes referred to as Divisia monetary aggregates).

Preferred benchmark rate equals 100 basis points plus the largest rate in the set of rates.

Alternative benchmark rate equals the larger of the preferred benchmark rate and the Baa corporate bond yield.

Suggested Citation:

Anderson, Richard G. and Jones, Barry E., Monetary Services Index: M3 (preferred) (DISCONTINUED) [MSIM3P], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/MSIM3P, .

Release Tables

Related Data and Content

Data Suggestions Based On Your Search

Content Suggestions

Related Categories

Releases

Tags

Permalink/Embed

modal open, choose link customization options

Select automatic updates to the data or a static time frame. All data are subject to revision.