Federal Reserve Economic Data

- Release Calendar

- FRED Tools

- FRED News

- FRED Blog

- About FRED

Data in this graph are copyrighted. Please review the copyright information in the series notes before sharing.

Notes

Source: National Bureau of Economic Research

Release: NBER Macrohistory Database

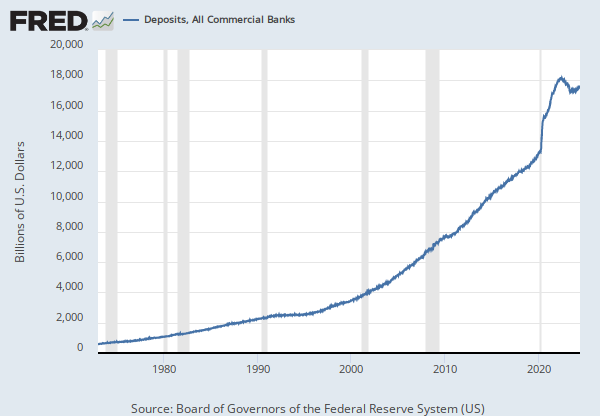

Units: Billions of Dollars, Not Seasonally Adjusted

Frequency: Monthly

Notes:

Data Are Monthly Averages Of Daily Figures. Figures For Total Deposits For 1914-1916 Are Not Available, Therefore Figures Presented Are For Net Deposits -- Gross Deposits Including Deferred Availability Accounts Minus Items In Process Of Collection And Other Uncollected Items. The Act Of May 12, 1933 Made All Coins And Currencies In U.S. Legal Tender Eligible For Use As Reserve Against Deposits. Since That Date, Cash Reserves Include Coins And Currency Not Previously Eligible For Such Use (See 1933 Annual Report, P. 94, Table 10). Beginning With 1942, Total Deposits Are No Longer Published On A Daily Average Basis. The Totals Here Have Been Obtained By Adding The Following Components Which Were Available On A Daily Cash Basis -- Member Bank Reserves; Treasury Deposits; Non-Member Deposits (The Sum Of Non-Member Bank Deposits And Deposits Of Government Agencies Of Foreign Banks And Governments. Source: Federal Reserve Board, Data For 1914-1933: Annual Report, 1928, Pp. 50-52; 1932, P. 52; 1933, P. 94. Data For 1934: Frb Bulletin, Successive Monthly Issues. Data For 1935-1941: Banking And Monetary Statistics, 1943, Pp. 349-350. Data For 1942-1949: Frb Bulletins.

This NBER data series m14070 appears on the NBER website in Chapter 14 at http://www.nber.org/databases/macrohistory/contents/chapter14.html.

NBER Indicator: m14070

Suggested Citation:

National Bureau of Economic Research, Total Deposits, Federal Reserve Banks for United States [M14070USM027NNBR], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/M14070USM027NNBR, .

Release Tables

Permalink/Embed

modal open, choose link customization options

Select automatic updates to the data or a static time frame. All data are subject to revision.