Federal Reserve Economic Data

- Release Calendar

- FRED Tools

- FRED News

- FRED Blog

- About FRED

Data in this graph are copyrighted. Please review the copyright information in the series notes before sharing.

Notes

Source: National Bureau of Economic Research

Release: NBER Macrohistory Database

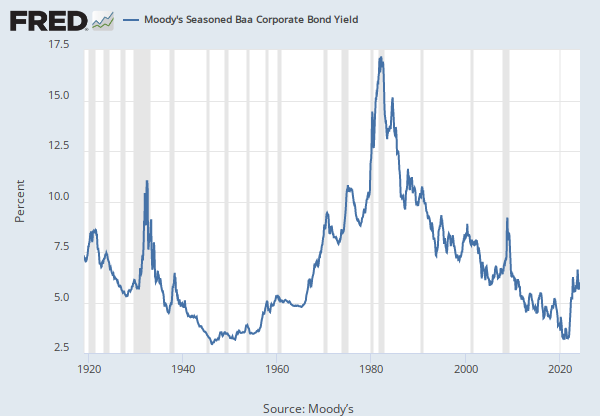

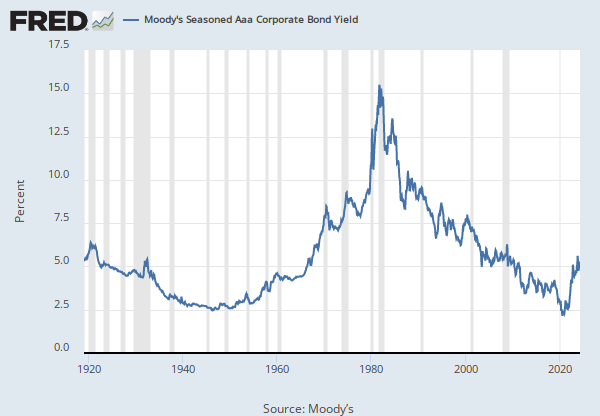

Units: Percent, Not Seasonally Adjusted

Frequency: Monthly

Notes:

Data For 1900-1928 Are Based Upon The Mean Of The Monthly High And Low Price Of Five High Grade Bonds. Data For 1929-1937 Are Based Upon A Varying Group Of A1+ Bonds, One Price Monthly Being Used. Data Beginning April 1937 Are Based On The Average Of The Four Or Five Weekly A1+ Indexes. The Yield To Maturity Has Been Used. Missing Data For August-October 1914 Is Due To The Stock Exchange Closing. Source: Standard And Poor'S, Data For 1900-1946: "Long Term Security Price Index Record (Through December 31, 1940)", P. 128;"Security Price Record: 1941 And 1943", P. 13;"Current Statistics Combined With Basic Statistics", 1944-1946. Data For 1947: "Statistics: Security Price Index Record", 1948 Edition, P. 134. Data For 1948-1950: "Current Statistics Combined With Basic Statistics", January Issues Of 1949-1950. Data For 1951-1963: "Current Statistics", February 1952 And Successive Issues.

This NBER data series m13025 appears on the NBER website in Chapter 13 at http://www.nber.org/databases/macrohistory/contents/chapter13.html.

NBER Indicator: m13025

Suggested Citation:

National Bureau of Economic Research, Index of Yields of High Grade Public Utility Bonds for United States [M13025USM156NNBR], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/M13025USM156NNBR, .

Release Tables

Related Data and Content

Data Suggestions Based On Your Search

Content Suggestions

Related Categories

Releases

Tags

Permalink/Embed

modal open, choose link customization options

Select automatic updates to the data or a static time frame. All data are subject to revision.