Federal Reserve Economic Data

- Release Calendar

- FRED Tools

- FRED News

- FRED Blog

- About FRED

Data in this graph are copyrighted. Please review the copyright information in the series notes before sharing.

Notes

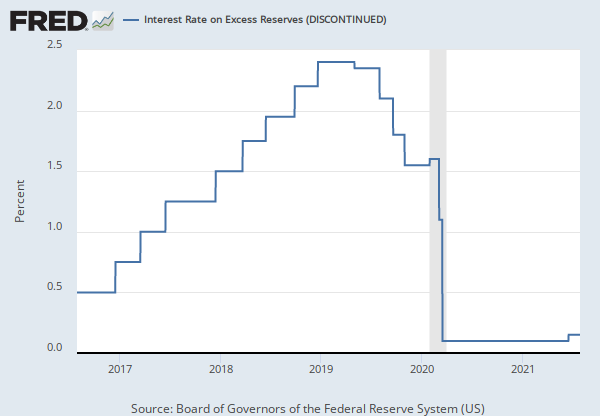

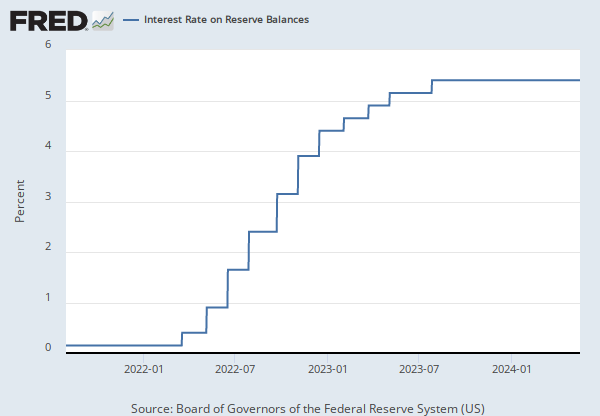

Source: Board of Governors of the Federal Reserve System (US)

Release: H.3 Aggregate Reserves of Depository Institutions and the Monetary Base

Units: Percent, Not Seasonally Adjusted

Frequency: Weekly, Ending Wednesday

Notes:

Balances maintained to satisfy reserve balance requirements up to and including the top of the penalty-free band are remunerated at the rate paid on balances maintained up to the top of the penalty-free band.

Effective February 2, 1984, reserve computation and maintenance periods have been changed from weekly to bi-weekly. Series with data prior to February 2, 1984 have different values reported from one week to the next. After February 2, 1984, the value repeats for 2 consecutive weeks.

Effective July 23, 2015, the Federal Reserve Board changed the formula for calculating interest for depository institutions with excess balances. The new formula is based on the daily interest rate on excess reserves (IOER rate) and the daily balance maintained, rather than the maintenance period IOER rate and the average balance maintained over the maintenance period. The IOER and IORR rates effective for a given day are now published on the "Interest on Required Balances and Excess Balances" page on the Federal Reserve Board's website at http://www.federalreserve.gov/monetarypolicy/reqresbalances.htm

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Interest Rate Paid on Balances Maintained to Satisfy Reserve Balance Requirements (DISCONTINUED) [INTRESREQW], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/INTRESREQW, .

Release Tables

Permalink/Embed

modal open, choose link customization options

Select automatic updates to the data or a static time frame. All data are subject to revision.