Federal Reserve Economic Data

- Release Calendar

- FRED Tools

- FRED News

- FRED Blog

- About FRED

Data in this graph are copyrighted. Please review the copyright information in the series notes before sharing.

Notes

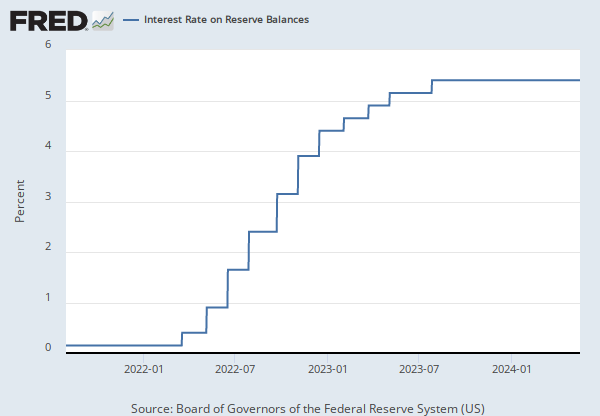

Source: Board of Governors of the Federal Reserve System (US)

Release: H.15 Selected Interest Rates

Units: Percent, Not Seasonally Adjusted

Frequency: Daily

Notes:

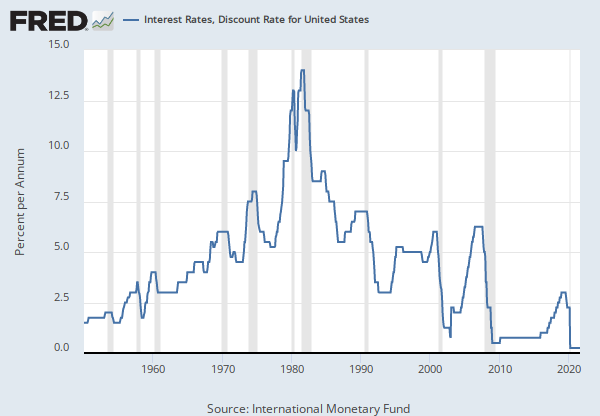

This data represent rate charged for discounts made and advances extended under the Federal Reserve's primary credit discount window program, which became effective January 9, 2003.

Primary credit is available to generally sound depository institutions at a rate set relative to the Federal Open Market Committee's (FOMC) target range for the federal funds rate. Depository institutions are not required to seek alternative sources of funds before requesting advances of primary credit. Primary credit may be used for any purpose, including financing the sale of federal funds. By making funds readily available at the primary credit rate the primary credit program complements open market operations in the implementation of monetary policy.

Reserve Banks ordinarily do not require depository institutions to provide reasons for requesting very short-term primary credit. Rather, borrowers are asked to provide only the minimum information necessary to process a loan, usually the amount and term of the loan.

This rate replaces that for adjustment credit, which was discontinued after January 8, 2003. For further information, see Board of Governor's announcement. The rate reported is that for the Federal Reserve Bank of New York.

For questions on the data, please contact the data source. For questions on FRED functionality, please contact us here.

Suggested Citation:

Board of Governors of the Federal Reserve System (US), Discount Window Primary Credit Rate [DPCREDIT], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/DPCREDIT, .

Release Tables

Related Data and Content

Data Suggestions Based On Your Search

Content Suggestions

Other Formats

Related Categories

Releases

Tags

Permalink/Embed

modal open, choose link customization options

Select automatic updates to the data or a static time frame. All data are subject to revision.