Federal Reserve Economic Data

- Release Calendar

- FRED Tools

- FRED News

- FRED Blog

- About FRED

Data in this graph are copyrighted. Please review the copyright information in the series notes before sharing.

NOTES

Source: World Bank

Release: Global Financial Development

Units: Percent, Not Seasonally Adjusted

Frequency: Annual

Notes:

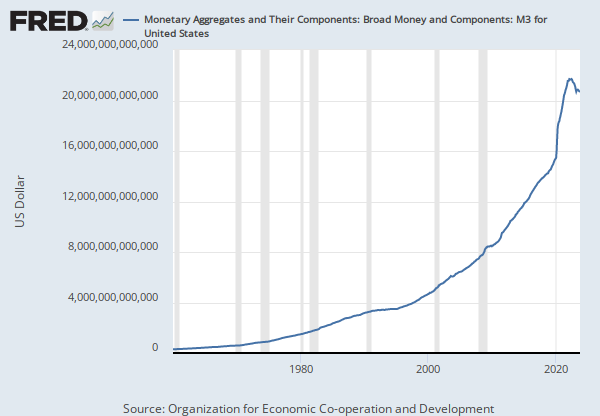

Ratio of liquid liabilities to GDP. Liquid liabilities are also known as broad money, or M3. They are the sum of currency and deposits in the central bank (M0), plus transferable deposits and electronic currency (M1), plus time and savings deposits, foreign currency transferable deposits, certificates of deposit, and securities repurchase agreements (M2), plus travelers checks, foreign currency time deposits, commercial paper, and shares of mutual funds or market funds held by residents.

Ratio of liquid liabilities to GDP, calculated using the following deflation method: {(0.5)*[Ft/P_et + Ft-1/P_et-1]}/[GDPt/P_at] where F is liquid liabilities, P_e is end-of period CPI, and P_a is average annual CPI. Raw data are from the electronic version of the IMF's International Financial Statistics. Liquid liabilities (IFS lines 55L..ZF or, if not available, line 35L..ZF); GDP in local currency (IFS line 99B..ZF or, if not available, line 99B.CZF); end-of period CPI (IFS line 64M..ZF or, if not available, 64Q..ZF); and annual CPI (IFS line 64..ZF). For Eurocurrency area countries (BEF, DEM, ESP, FRF, GRD, IEP, ITL, LUF, NLG, ATS, PTE, FIM), liquid liabilities are estimated by summing IFS items 34A, 34B and 35. (International Monetary Fund, International Financial Statistics, and World Bank GDP estimates)

Source Code: GFDD.DI.05

Suggested Citation:

World Bank, Liquid Liabilities to GDP for Denmark [DDDI05DKA156NWDB], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/DDDI05DKA156NWDB, .

RELEASE TABLES

RELATED DATA AND CONTENT

Data Suggestions Based On Your Search

Content Suggestions

Related Categories

Releases

Tags

Permalink/Embed

modal open, choose link customization options